Amazon, the e-commerce and cloud computing giant, has been making significant strides in various aspects of its business. This blog post will delve into the company’s recent developments, focusing on its logistics operations, e-commerce strategies, and cloud computing services. We’ll explore how Amazon is leveraging its strengths to improve asset turnover, enhance profitability, and position itself for future growth in an increasingly competitive landscape.

Third-Party Logistics: The Key to Increased Asset Turnover

Buy with Prime: Expanding Beyond Amazon’s Marketplace

One of the most crucial elements in Amazon’s strategy to boost its asset turnover rate is its focus on third-party logistics. The company has introduced a service called “Buy with Prime,” which allows customers to use Amazon’s delivery service for transactions that occur on third-party seller online marketplaces, not just on Amazon’s own platform.

Impact on Asset Utilization

This move is significant because it allows Amazon to leverage its extensive logistics network more efficiently. By offering its delivery services to transactions outside its own marketplace, Amazon can increase the utilization of its assets, leading to a higher asset turnover rate. This strategy helps Amazon maximize the return on its substantial investments in warehouses, delivery vehicles, and other logistics infrastructure.

Regionalization: Improving Efficiency and Cash Flow

Segmenting the Logistics Network

Another key factor contributing to Amazon’s recent improvement in asset turnover rate is its successful implementation of regionalization. This strategy involves segmenting the logistics network and proactively stocking frequently transferred inventory in specific regions.

Benefits of Localization

The effects of this localization effort are reflected in the improvement of Amazon’s operating cash flow in recent quarters. By strategically positioning inventory closer to demand centers, Amazon can reduce transportation costs, improve delivery times, and enhance overall operational efficiency.

Cash Flow Improvements

The regionalization strategy has had a positive impact on Amazon’s cash flow, as evidenced by recent financial reports. By optimizing its inventory placement and reducing the distance between storage locations and customers, Amazon has been able to convert sales into cash more quickly and efficiently.

Profitability Improvements Outside North America

Expansion of Integrated Delivery

One of Amazon’s most notable achievements has been the improvement of profitability in regions outside North America. This success can be attributed to the expansion of integrated delivery services centered around regional logistics centers.

Cost Savings

The strategic placement of regional logistics centers has resulted in significant savings for Amazon in several areas:

- Transportation fees: By reducing the distance between warehouses and customers, Amazon can lower its shipping costs.

- Service costs: Centralized regional operations allow for more efficient use of resources and personnel.

Competitive Advantage in Logistics

Despite facing intensifying competition from Chinese e-commerce companies such as AliExpress and TEMU, Amazon’s progress in profitability improvement confirms its competitive advantage in the logistics sector. This advantage is crucial in maintaining Amazon’s market position and supporting its global expansion efforts.

AWS: Challenges and Opportunities in Cloud Computing

Recent Growth Challenges

Amazon Web Services (AWS), the company’s cloud computing arm, has faced some challenges in recent quarters. The delay in AWS growth over the past year can be attributed to several factors:

- High-cost structured data workloads: These workloads, which traditionally drove database sales, have been a primary source of revenue for AWS.

- Shift to low-cost unstructured data: During the high-interest rate environment, many customers have opted to convert their workloads to low-cost unstructured data formats.

- Cost-saving demands: Customers have been seeking ways to optimize their cloud spending through more efficient use of storage resources.

Impact on Storage Sector

The storage sector, a subsector of Infrastructure as a Service (IaaS), underperformed in 2023 compared to other sectors like computation and networking. This underperformance was due to:

- Demand for cost savings through efficient use of storage resources during high-interest phases.

- Transition of workloads that drive database resource usage from high-cost structured data to low-cost unstructured data.

AWS Market Leadership

Despite these challenges, it’s important to note that AWS remains the global market share leader in the IaaS Storage business sector. However, the company’s large exposure to this sector has acted as a burden on the recovery of external growth. The deterioration of the sales mix due to the demand for cloud cost optimization and data migration has impacted AWS’s performance.

Future Outlook: LLMs and Unstructured Data Demand

Shift in Customer Priorities

As we look to the future, there are several factors that suggest a positive outlook for Amazon and AWS:

- Decreasing demand for cost optimization: As economic conditions stabilize, the intense focus on cost-cutting is expected to diminish.

- Increasing demand for unstructured data computing: The introduction and proliferation of Large Language Models (LLMs) is driving a surge in demand for computing resources capable of handling large amounts of unstructured data.

Potential for External Growth

The increasing demand for unstructured data computing resources is expected to drive Amazon’s external growth. This trend has already been visualized as an improvement in Operating Profit Margin (OPM) in recent quarters.

AWS Positioning

AWS is well-positioned to capitalize on this shift in demand. As a leader in cloud computing services, AWS has the infrastructure and expertise to support the computational needs of LLMs and other AI-driven technologies that rely heavily on unstructured data processing.

E-commerce Competition and Strategy

Chinese Competitors

Amazon faces increasing competition in the e-commerce space, particularly from Chinese companies such as AliExpress and TEMU. These competitors have been expanding their global presence and offering competitive prices to attract customers.

Amazon’s Competitive Edge

Despite this intensifying competition, Amazon’s improvements in profitability, particularly in regions outside North America, demonstrate its strong competitive position. The company’s advantages include:

- Established logistics network: Amazon’s extensive and efficient delivery infrastructure gives it an edge in fulfillment speed and reliability.

- Prime membership ecosystem: The benefits associated with Amazon Prime, including the “Buy with Prime” service, help to retain customers and drive loyalty.

- Diverse product offering: Amazon’s vast marketplace, combining first-party and third-party sellers, provides customers with an unparalleled selection of products.

Strategic Focus on Logistics

Amazon’s continued investment in and optimization of its logistics operations serve as a key differentiator from its competitors. The company’s ability to offer fast, reliable delivery not just for its own marketplace but also for third-party sellers through “Buy with Prime” strengthens its position in the e-commerce landscape.

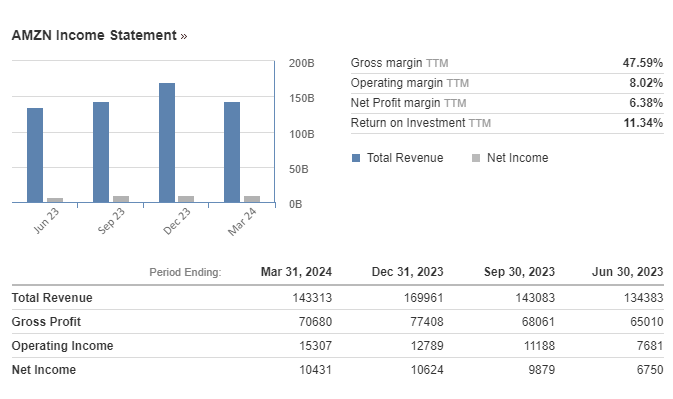

Financial Implications and Performance Metrics

Asset Turnover Rate

The asset turnover rate is a key financial metric that measures how efficiently a company uses its assets to generate revenue. Amazon’s focus on third-party logistics and regionalization has contributed to an improvement in this metric. While specific numbers are not provided in the source material, it’s clear that these strategies are having a positive impact on Amazon’s asset utilization.

Operating Cash Flow

The improvements in Amazon’s logistics operations, particularly the regionalization efforts, have resulted in enhanced operating cash flow. This metric is crucial as it represents the cash generated from the company’s core business operations. A strong operating cash flow indicates that Amazon is efficiently converting its sales into cash, which can be used for investments, debt repayment, or returned to shareholders.

Operating Profit Margin (OPM)

Recent quarters have shown an improvement in Amazon’s Operating Profit Margin, particularly driven by the increasing demand for unstructured data computing resources. This improvement suggests that Amazon is not only growing its revenue but also becoming more efficient in its operations, leading to higher profitability.

Technological Innovations and Their Impact

Large Language Models (LLMs)

The rise of Large Language Models represents a significant technological shift that is impacting Amazon’s business, particularly its AWS division. LLMs require substantial computing power and storage capabilities, areas where AWS excels.

Implications for AWS

- Increased demand for cloud resources: As more companies and researchers develop and deploy LLMs, the demand for cloud computing resources is expected to grow significantly.

- Shift in data storage needs: LLMs typically work with unstructured data, which aligns well with the recent trends in AWS’s storage business.

- Potential for new services: AWS may develop new services or tools specifically designed to support the development and deployment of LLMs, creating new revenue streams.

Impact on E-commerce

While LLMs are primarily relevant to AWS, they also have potential implications for Amazon’s e-commerce business:

- Enhanced search and recommendation systems: LLMs could improve product search functionality and personalized recommendations on Amazon’s marketplace.

- Improved customer service: AI-powered chatbots based on LLMs could enhance Amazon’s customer service capabilities.

- Content generation: LLMs could be used to generate product descriptions, reviews summaries, and other content to enhance the shopping experience.

Global Expansion and Regional Strategies

Profitability Outside North America

Amazon’s improved profitability in regions outside North America is a significant achievement. This success can be attributed to several factors:

- Expansion of integrated delivery services

- Establishment of regional logistics centers

- Optimization of transportation and service costs

Tailoring Strategies to Regional Markets

As Amazon continues to expand globally, it’s likely that the company will need to tailor its strategies to suit different regional markets. This may involve:

- Adapting to local e-commerce preferences and behaviors

- Navigating different regulatory environments

- Competing with strong local and regional e-commerce players

Balancing Global Scale with Local Adaptability

Amazon’s challenge will be to leverage its global scale and logistics expertise while remaining adaptable to local market conditions. The success of its regionalization strategy suggests that the company is capable of striking this balance.

The Role of Prime in Amazon’s Ecosystem

Buy with Prime

The “Buy with Prime” service is a key component of Amazon’s strategy to extend its reach beyond its own marketplace. This service offers several benefits:

- Increased utilization of Amazon’s logistics network

- Extension of Prime benefits to transactions on other platforms

- Potential to capture data on consumer behavior outside of Amazon’s ecosystem

Prime Membership Value Proposition

By offering Prime delivery services on other platforms, Amazon enhances the value proposition of Prime membership. This could lead to:

- Increased Prime membership sign-ups

- Higher retention rates for existing Prime members

- Greater customer loyalty across multiple shopping platforms

Impact on Third-Party Sellers

The “Buy with Prime” service also has implications for third-party sellers:

- Access to Amazon’s efficient logistics network

- Potential for increased sales by offering Prime delivery options

- Stronger integration with Amazon’s ecosystem, potentially leading to more sales on Amazon’s own marketplace

Sustainability and Environmental Considerations

Logistics Optimization

While not explicitly mentioned in the provided information, Amazon’s focus on regionalization and logistics optimization likely has environmental implications:

- Reduced transportation distances could lead to lower carbon emissions

- More efficient use of warehousing space may result in a smaller environmental footprint

- Optimized inventory management could reduce waste from overstocking or spoilage

Cloud Computing Efficiency

AWS’s shift towards handling more unstructured data and its focus on cost optimization for customers may also have sustainability benefits:

- More efficient use of storage resources could lead to reduced energy consumption

- The shift to cloud computing itself often results in lower overall energy use compared to on-premises data centers

Future Considerations

As environmental concerns become increasingly important to consumers and regulators, Amazon’s ability to demonstrate sustainability in its operations could become a key differentiator. Future strategies may need to explicitly address environmental impact alongside financial and operational considerations.

As Amazon continues to evolve its strategies across e-commerce, cloud computing, and logistics, it will be crucial for the company to maintain its innovative edge, adapt to regional markets, and address emerging challenges such as sustainability. The company’s ability to leverage its strengths across these diverse business areas positions it well for continued growth and success in the coming years.